A clerk at the Sustainable Development Thompson District office seems to have siphoned an unknown amount of money away from the sale of hunting and finishing licences over six years because of lax record-keeping and financial safeguards, the Office of the Auditor General said in a report released Nov. 6.

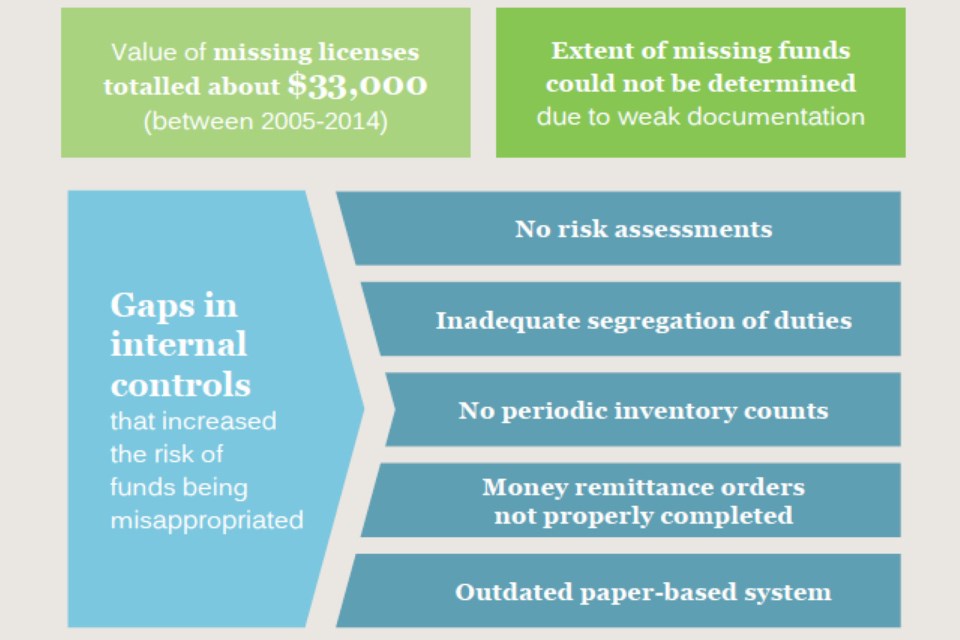

A special forensic audit of the Sustainable Development Thompson District Office found weaknesses in record-keeping and financial controls that allowed $33,000 worth of hunting and fishing licences to go missing from 2005 to 2014.

The audit was requested by the minister of finance on May 27, 2014 after the department discovered a missing deposit and missing licences at the Thompson District Office. Preliminary investigation into the missing deposit and licences led to the firing of the district clerk who department officials felt was responsible and the auditor general’s office agreed to perform the audit on May 29 of that year.

In addition to the $33,341 worth of missing licences that the department knew about, the audit determined that it was possible, in the case of cash sales, that licence copies were destroyed and the cash that had been paid for them misappropriated.

“We found a number of irregularities that suggest funds were misappropriated,” the report said. “However, we could not estimate the amount of misappropriated funds because of weaknesses in the documentation maintained by the Branch.”

The report said that such misappropriations are often covered up through a technique known as lapping, where subsequent cheque sales are used to cover up previous cash sales in which the money received was not recorded or deposited. In looking for evidence of such activities, the audit found that the names of purchasers on money remittance orders (MROs) – which recorded the names of buyers, the method of payment and the amounts received – did not match names on submitted cheques and that many MROs did not list purchasers but only licence numbers and totals which made it impossible to link a specific cheque to a specific purchase.

“Deposit slips list cheque amounts but there can be many cheques for the same amount making it impossible to connect a specific person’s cheque to the sale of a licence and conversely, making it possible to conceal the misappropriation of cash,” said the report.

The district clerk also sometimes said that a person had paid by cash when they actually paid by cheque and that these cheques were then recorded on other MROs at a later date but attributed to different people.

In the case of caribou hunting licence sales at the office, it was difficult for the auditors to track sales because licences were sometimes bought by one person but paid for by another. The audit also found that in a one-year period, the office received 84 cheques. The average time it took to deposit them was 38 days; for 36 of them, the time it took ranged from 37 to 87 days, with an average time of 73 days.

“Cheques should be deposited daily, but at least weekly when volumes are low,” said the report. “Long delays like the ones that occurred at the district office may indicate cheques were withheld for future use to cover for misappropriated cash.”

The auditor general also said that the district office had Crown land revenue and revenue from shower sales at campsites that could not be reconciled. In the case of the shower sales, the cash received was not reconciled to the coin machine logs.

The incident that led department officials to look into the record-keeping and financial transactions at the office occurred in 2013 when a deposit of nearly $15,000 from caribou licence sales in June was discovered in September to have never been made. The clerk said that she had told a summer student to make the deposit and mail the MRO but the student said she had never received the clerk’s note. The clerk said that when it was discovered in September that the deposit had not been made, she found the missing documentation, cash and cheques in a safe and told another staff member to make the deposit but this staff member denied having been asked to do so. During the course of the departmental investigation into the missing money and documents, it was also discovered that some of the licence had been purchased by employees of the department and that their cheques and other cheques used to buy caribou licences in June were coded with a different MRO than the one corresponding to the MRO she said she had found in the safe.

“If done properly, these cheques would have been included in the deposit that the District Clerk said she found in the back of the safe,” the audit report said.

Having one person be in charge of multiple tasks like maintaining licence inventories, selling those licences, recording the transactions, and preparing and making bank deposits make the possibility of funds being misappropriated more likely, the audit said, as does failure to record licence purchasers’ names and the dates of individual sales on MROs. Not doing timely bank reconciliations and relying on paper-based licences also results in a weaker system of internal controls, said the report.

The department told the auditor general that over the last four years it has been doing annual spot audits and site reviews on a random basis at various department offices, though it has trouble segregating financial and record-keeping duties in some of them because of limited staff. It also said that it has improved inventory transfer and receipt procedures to better document the audit trail on inventory movements. The department has a goal of ensuring bank reconciliations take place monthly and Financial Services Branch staff are developing monthly reports on licence, pass and permit sales, accounts receivable, accounts receivable collections, inventory, and bank reconciliations for the executive financial officer's and deputy minister's review and approval.