The City of Thompson’s 2022 budget is by far the biggest it’s ever been thanks to federal-provincial infrastructure funding for roads, the water and sewer system and a new pool, but residential property owners will see only a slight increase in their property taxes over last year.

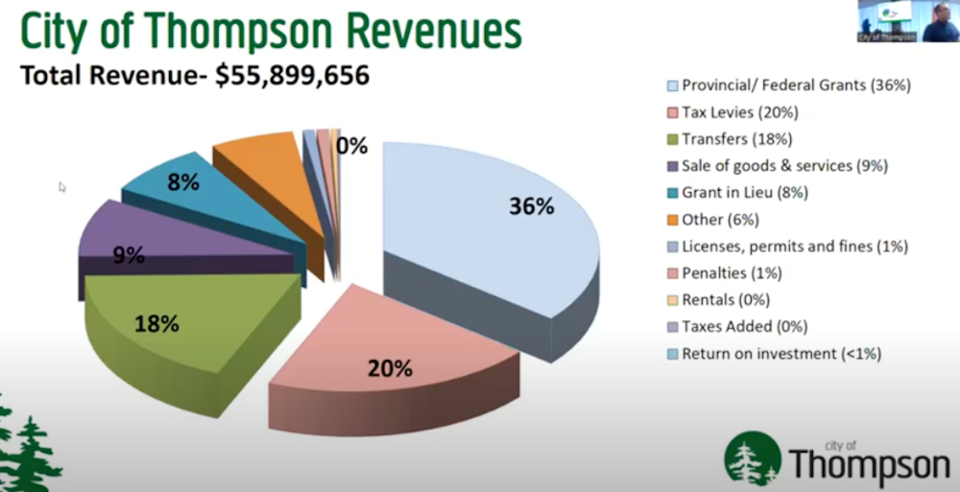

The entire budget is nearly $56 million dollars, 36 per cent of which — approximately $20 million — comes from federal and provincial grants.

The city portion of property taxes is the same as it was last year, while the overall property tax mill rate is up 0.2 per cent due to a slight increase in the School District of Mystery Lake portion. The impact for the owner of a home worth about $175,000, which the provincial assessment branch says is the average home price in the city, will go up $7 as a result. There is also an added cost of about $20 over last year for residential property owners due to an increase in the special levy to cover the cost of water breaks on residential properties. That amount is calculated based on the amount the city actually spent on such repairs in the previous year.

The overall tax bill for commercial properties is decreasing a little.

A handful of residents expressed support for or opposition to the budget at a June 9 public hearing, before it was approved by council in a 6-2 vote on June 13.

Frequent critic of the city and council, former councillor Ron Matechuk, was one of those opposed.

“There are a few things in there that are questionable,” he said, before questioning the city manager on a number of budget-related topics.

Also in opposition was Adam Morin, who said that the city’s current estimate for the cost of a new pool — about $24 million — would likely be much lower than the actual cost.

“Most buildings this size and in this type of area, they usually go over budget by 30 per cent,” he said.

The city’s plan is to fund its portion of the pool construction costs, about $9.2 million based on current estimates, through debenture, with hopes that fundraising will help reduce the amount that must be borrowed by the time the new facility is complete.

In a written submission, Sandra Oberdorfer, a former SDML trustee, said she was in favour of the budget as presented.

“As a taxpayer with a young family, I’m very happy to see the City of Thompson supporting a new aquatic facility in our community,” she wrote. “It is a well thought-out budget and a sound plan for net financing the future product.”

Malanie Cutler did not initially give an opinion on the budget but later said she was in favour.

The budget, which uses about $255,000 from reserves to balance revenues with expenses without increasing taxes, was passed four days after the public hearing at council’s June 13 meeting, where a couple of councillors said that, although they were happy with the tax freeze, the timing was suspect.

“Because of my conscience, because of what I’ve heard the people saying in Thompson, I will support the budget because I have to,” said Coun. Les Ellsworth, who has said he intends to run for mayor of Thompson in the October municipal election. “I believe we’re getting zero budget because it’s an election year and I think that’s wrong.”

Coun. Duncan Wong, who voted against the budget along with Coun Jeff Fountain, made similar remarks during debate on the levy bylaw, which establishes the mill rates used to calculate property taxes.

“The budget is not based on financial decisions, it’s based on political decisions because of the election,” he said.

Fountain’s opposition was based on his concerns about the future impact of financial and maintenance liabilities.

“I’m concerned about the amount of liabilities the city has,” he said. “I’m concerned about those liabilities in that were continually adding new infrastructure. Meanwhile were keeping and trying to maintain old infrastructure.”

A little over two-thirds of the city’s budget is accounted for by salaries and wages (46 per cent) and the RCMP policing contract (23 per cent).