Rising costs of fuel and food are putting further economic pressure on northern and Indigenous Canadians who already faced a higher cost of living before the current inflation crisis, NDP MPs said in Ottawa Nov. 30.

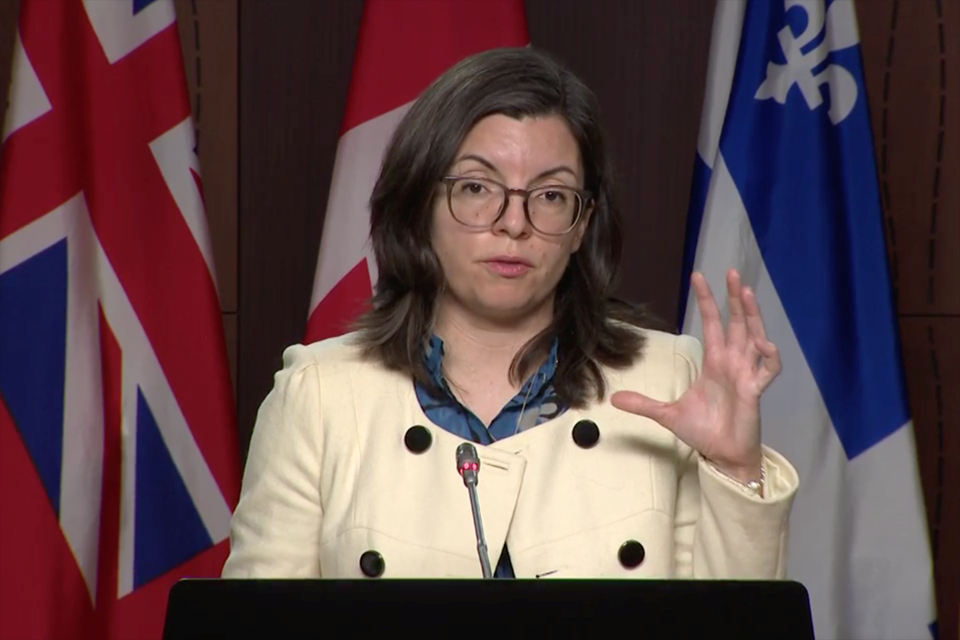

Niki Ashton, who represents the Churchill-Keewatinook Aski riding encompassing all of Northern Manitoba, and Lori Idlout, Nunavut MP, held a press conference to ask the federal government to reform its Nutrition North food subsidy program and to exempt home heating fuel from GST.

Virtually all of Nunavut’s communities rely on diesel to generate electricity, as do some of the 18 remote communities in Ashton’s riding that don’t have year-round road access and may not be connected to Manitoba’s hydroelectricity grid.

Ashton shared prices of grocery items from some of the communities in her riding, including Shamattawa, where a frozen pizza is more than $12 snd a one-litre bottle of drinking water can be as much as $7.09.

“People cannot afford to live with these prices,” she said, noting that high fuel costs ranging from $2.35 to over $3 a litre may impact some remote community residents’ plans to stock up on supplies when winter roads open.

“People are increasingly concerned that with the costs of fuel they won’t be able to afford to get out to our major centres, whether it’s Thompson or Winnipeg, to shop for cheaper and healthier food items.”

Reforms are also needed to ensure that Nutrition North food subsidies benefit the people buying groceries rather than the companies selling them, such as NorthMart, one of the few grocery stories in many northern communities across Canada, the MPs said.

“There needs to be a better way to ensure that NorthMart has been held accountable for the program that it’s delivering on behalf of our government of Canada,” Idlout said.

The cost of reforms and GST exemptions could easily be made up for with a windfall tax on big fuel, grocery and big box companies, the MPs said, noting that NorthMart’s net earnings last year were $157 million, up nearly 10 per cent from the previous year.

The MPs said the Parliamentary Budget Office estimates that the NDP’s windfall tax proposal could bring in more than $4 billion of revenue over five years.

Kyle Allen, spokesperson for Crown-Indigenous Relations and Northern Affairs Canada, the department that administers Nutrition North, told Nunatsiaq News in Nunavut that the federal government has increased its funding for the various programs under its wing.

He said the harvesters support grant was developed in partnership with northern communities and supported more than 5,500 harvesters.

The federal government also has programs outside of Nutrition North to help northerners with the increasing cost of living, such as reducing child-care fees and increasing the Canadian Workers Benefit.

“Many Canadians face real challenges with the increased cost of living,” he said.

“That is why we have a fiscally responsible and compassionate plan that is targeted to low-income families and individuals and support for the most vulnerable.”

Allen did not answer if the Liberals would commit to reviewing the Nutrition North program.

- with files from David Venn, Local Journalism Initiative Reporter, Nunatsiaq News